SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Filed by the Registrant ☑

Filed by a Party other than the Registrant

☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Check the appropriate box: |

☐ | | | Preliminary Proxy Statement

|

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

|

Tompkins Financial Corporation |

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| 1) | TitlePayment of each class of securities to which transaction applies:Filing Fee (Check the appropriate box): |

☑ | 2) | Aggregate number of securities to which transaction applies: | No fee required. |

☐ | 3) | Per unit price or other underlying value of transaction | Fee paid previously with preliminary materials. |

☐ | | | Fee computed pursuant toon table in exhibit required by Item 25(b) per Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculatedRules 14a-6(i)(1) and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid:0-11. |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

March 29, 2021

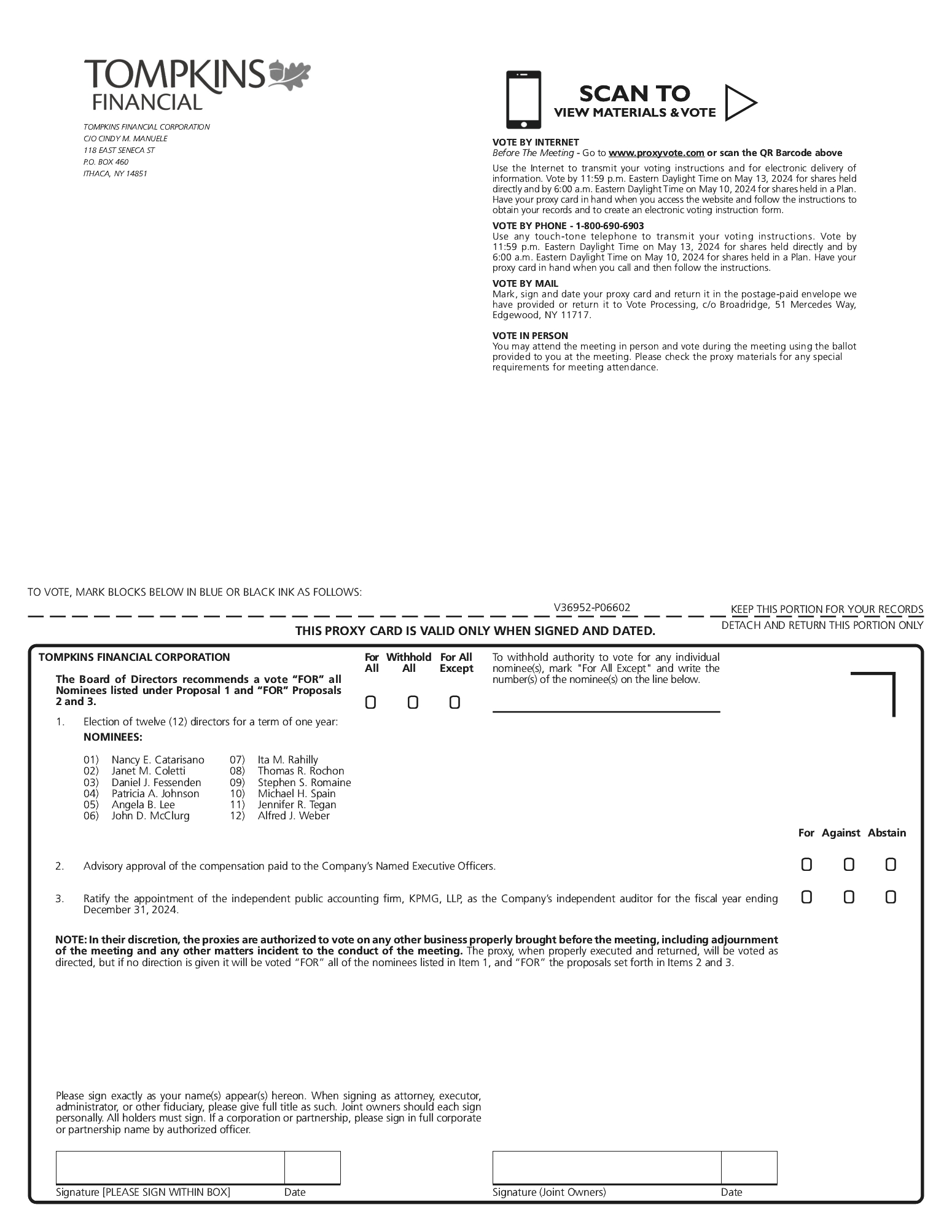

NOTICE OF 20212024 ANNUAL MEETING OF SHAREHOLDERS

OF TOMPKINS FINANCIAL CORPORATION

The Annual Meeting of Shareholders (the “Annual Meeting”) of Tompkins Financial Corporation

(the(“Tompkins” or the “Company”) will be held on Tuesday, May

11, 2021,14, 2024 at 10:00 a.m. at the Company’s headquarters, located at 118 E. Seneca Street, Ithaca, New York, 14850, for the following purposes:

| 1.

| To elect the thirteen (13) Directorstwelve (12) directors named in the Proxy Statementaccompanying proxy statement for a term of one year expiring in 2022;2025; |

| 2.

| To conduct an advisory vote to approve, on a non-binding basis, the compensation paid to the Company’s Named Executive Officers;named executive officers; |

| 3.

| To ratify the appointment of the independent registered public accounting firm, KPMG LLP, as the Company’s independent auditor for the fiscal year ending December 31, 2021;2024; and |

| 4.

| To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

To be responsiveIf you wish to attend the Annual Meeting in person, you must register your planned in-person attendance with us at least five (5) business days prior to the

recommendations of public health officials regarding Coronavirus,meeting by writing to Tracy Kinner, Executive Assistant, Tompkins Financial Corporation, PO Box 460, Ithaca, NY 14851, or by email at tkinner@tompkinsfinancial.com. Pre-registration and

formatching picture identification are necessary to gain entrance to the

health and safetysecure area of our

shareholdersheadquarters building where the meeting will be held. Parking is generally available on-street, or at the public garages on Seneca Street and

our employees, our 2021 Annual MeetingCayuga Street. The parking spaces under the building will be reserved for those requiring accessible parking with a valid plate or placard. The meeting will focus largely on the business items described in the Proxy Statement. A brief question and answer session will be held

virtually. We encourage all of our shareholders to participate inimmediately following the meeting.

Shareholders participating remotely via the webcast will be offered the opportunity to vote, make comments or ask questions electronically. Instructions for how to participate virtually are posted at www.virtualshareholdermeeting.com/TMP2021. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 844-986-0822 (US) or 303-562-9302 (International) to speak with a representative from Broadridge Financial Solutions, the vendor who is providing technical support for the virtual meeting. You will need the control number printed on your proxy or notice card in order to authenticate yourself as a shareholder and gain access to the meeting. Due to these extraordinary public health circumstances, we will not be holding an in-person meeting, nor will we be holding regional informational meetings in Western New York, the Hudson Valley and Pennsylvania. Please know that we are making this decision with great reluctance, as we truly value the opportunity to have more personal engagement with our shareholders. We also understand that circumstances may be very different in early May, but we have to make the best decision we can based on information available to us today. We have elected to take advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to certain shareholders over the

Internet.internet. We believe furnishing proxy materials to our shareholders over the

Internetinternet allows us to provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. If you have received the Notice of Internet Availability, you will not receive a printed copy of the proxy materials unless you request it by following the instructions for requesting such proxy materials contained in the Notice of Internet Availability and summarized in the proxy statement.

The Company’s Board of Directors (the “Board”) has fixed the close of business on March 15,

20212024 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date are entitled to vote at the Annual Meeting.

The Board of Directors unanimously recommends that you vote “

FOR” each of the

Directordirector nominees named in the enclosed

Proxy Statement,proxy statement, “

FOR” advisory approval of the compensation paid to the Company’s

Named Executive Officers,named executive officers, and “

FOR” ratification of the appointment of KPMG LLP as the Company’s independent auditor for the fiscal year ending December 31,

2021. 2024. Your vote is important regardless of the number of shares you own. It is important that your common shares be represented at the Annual Meeting whether or not you are personally able to attend. Accordingly, after reading the accompanying Proxy Statement,proxy statement, please promptly submit your proxy by telephone, Internetinternet or mail as described in the Proxy Statement.proxy statement. Submitting your proxy by telephone, Internet or mail does not deprive you of the right to attend or vote at the Annual Meeting andor to vote your common shares in the manner described in the accompanying Proxy Statement.proxy statement.By Order of the Board of Directors, | | | | | | |

| | | | | | |

| |  | |

Chair

| | Amanda L. Lippincott

| | | | Cynthia M. Manuele

Corporate Counsel & Deputy Corporate Secretary | |

TOMPKINS FINANCIAL CORPORATION, P.O. BOX 460, ITHACA,

NEW YORKNY 14851 (607) 273-3210

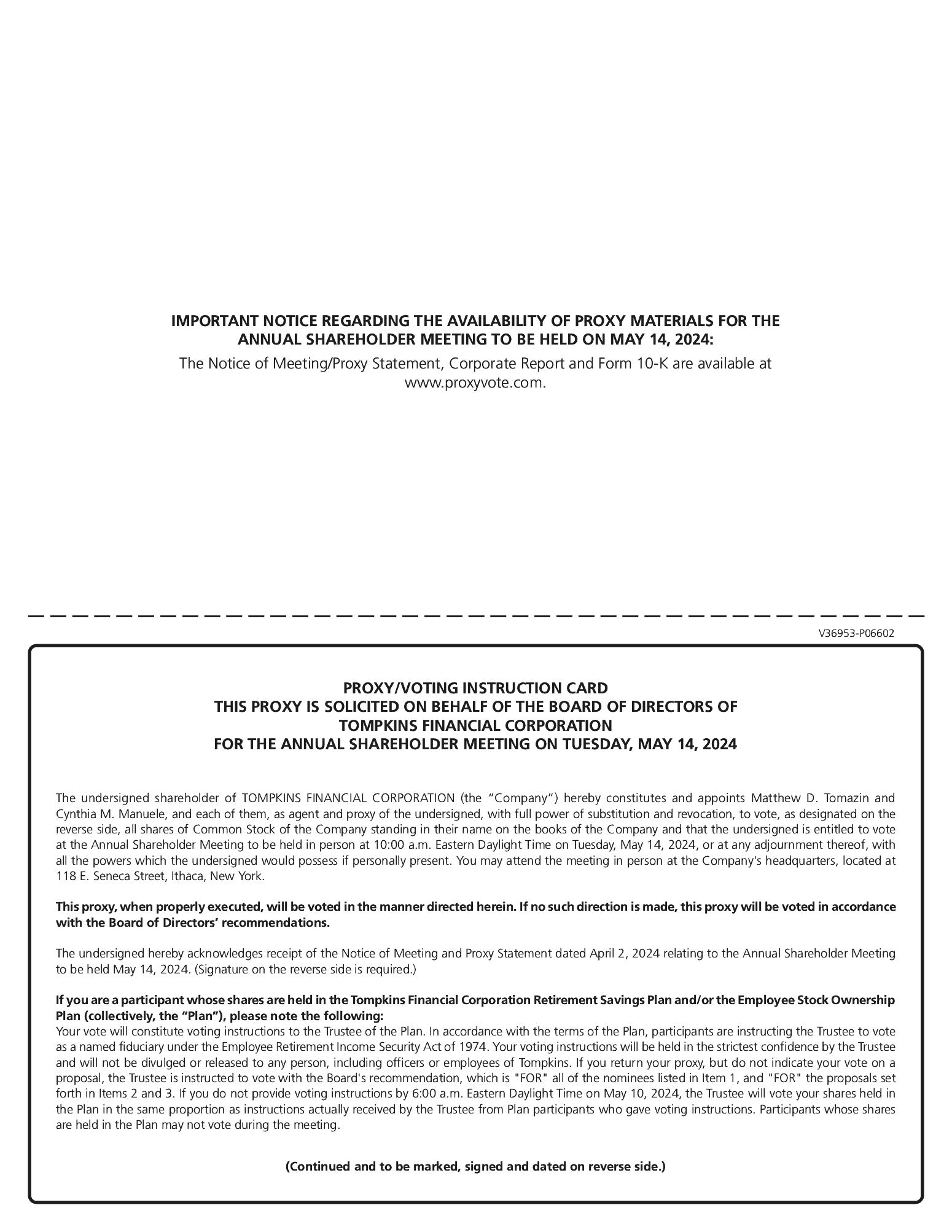

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD MAY

11, 202114, 2024

This Proxy Statement,proxy statement, the corporate report and the Company’s Annual Reportannual report on Form 10-K and the Company’s Corporate Report to shareholders are available

under the “SEC Filings” tab at

www.tompkinsfinancial.com.www.tompkinsfinancial.com

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY

11, 202114, 2024

We are providing this

Proxy Statementproxy statement (the “Proxy Statement”) in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Tompkins Financial Corporation (“Tompkins” or the “Company”) for use at the Annual Meeting of Shareholders, to be held on Tuesday, May

11, 202114, 2024 at

5:30 p.m.10:00 a.m. Eastern Daylight Saving Time (the “Annual Meeting”)

. at the Company’s headquarters, 118 E. Seneca Street, Ithaca, New York, 14850. The Annual Meeting will be held

in a virtual format and accessible at www.virtualshareholdermeeting.com/TMP2021.in-person. This Proxy Statement summarizes the information that you will need in order to vote. We first made this Proxy Statement available to shareholders on

March 29, 2021. Instructions for how to attend the Annual Meeting virtually are posted at www.virtualshareholdermeeting.com/TMP2021. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or

meeting time, please call 844-986-0822 (US) or 303-562-9302 (International) to speak with a representative from Broadridge Financial Solutions, the vendor who is providing technical support for the virtual meeting. You will need the control number printed on your Notice of Internet Availability or proxy card in order to authenticate yourself as a shareholder and gain access to the Annual Meeting.about April 2, 2024.

Availability of Proxy Materials

In accordance with rules adopted by the SEC, instead of mailing a printed copy of our proxy materials to each shareholder of record, we furnished our proxy materials, including the Notice of Annual Meeting of Shareholders, this Proxy Statement,

Tompkins’ 2020 Corporate Report,the corporate report and the

Annual Reportannual report on Form 10-K for the fiscal year ended December 31,

2020,2023 (the “Annual Report”), by sending a notice of internet availability of proxy materials (the “Notice of Internet Availability”) and providing access to such documents over the

Internet.internet. Generally, shareholders will not receive printed copies of the proxy materials unless they request them. Shareholders of record who prefer to receive a paper or e-mail copy of our proxy materials must follow the instructions below or as provided in the Notice of Internet Availability for requesting such materials. The Notice of Internet Availability only identifies the items to be voted on at the Annual Meeting. You cannot vote by marking the Notice of Internet Availability and returning it.

To view ONLINE

: visit www.ProxyVote.com 24 hours a day, seven days a week, through the conclusion of the Annual Meeting. You will need your Notice of Internet Availability with your control number in order to log in and view the proxy materials.

To receive a PAPER or E-MAIL copy

: you MUST REQUEST a paper or e-mail copy of the proxy materials. There is NO charge to receive a paper or e-mail copy of the materials. Please choose one of the following methods for your request prior to April 27, 2021:26, 2024:| | (1) By Internet: | | | You may request mailed proxy materials or sign-up for e-mail delivery by clicking on “Sign-up for E-Delivery.” | |

| | (2) By Telephone: | | | 1-800-579-1639 | |

| | (3) By E-Mail: | | | To request materials, please send an e-mail to sendmaterial@proxyvote.comand include your control number (available on your Notice of Internet Availability) in the subject line.

The body of the e-mail MUST include the following:

●

• your preference to receive printed proxy materials via mail or e-mail, and ● if

• whether you would like this election to apply to the delivery of materials for all future shareholder meetings. | |

If your shares are held by a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of the shares, and those shares are referred to as being held in “street name.” As the beneficial owner of those shares, you have the right to direct your broker, bank, or nominee how to vote your shares, and you should receive separate instructions from your broker, bank, or other holder of record describing how to vote your shares and access the proxy materials. You also are invited to attend the Annual Meeting. However, because a beneficial owner is not the shareholder of record, you may not vote these shares at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Only shareholders of record at the close of business on March 15,

20212024 are entitled to receive notice of and to vote at the Annual Meeting. On March 15,

2021,2024, there were

14,906,72414,405,020 shares of the Company’s common stock, par value $0.10 per share (our “common stock”), outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. Other than the common

shares,stock, there are no voting securities of Tompkins outstanding. There is no cumulative voting with respect to the election of directors.

Shareholders of record may vote their common

sharesstock through the following methods:

| ● | by traditional paper proxy card (by requesting a paper copy of our proxy materials or downloading and printing a proxy card via the Internet at www.ProxyVote.com; |

| ● | via the Internet at www.ProxyVote.com; |

| ● | by telephone at 1-800-690-6903; or |

| ● | during the Annual Meeting at www.virtualshareholdermeeting.com/TMP2021. |

by traditional paper proxy card (by requesting a paper copy of our proxy materials or downloading and printing a proxy card via the Internet at www.ProxyVote.com;

via the Internet at www.ProxyVote.com;

by telephone at 1-800-690-6903; or

in person during the Annual Meeting.

The deadline for submitting voting instructions via the Internet or by telephone for shares held directly is 11:59 p.m., Eastern Daylight Saving Time, on May

10, 2021.13, 2024. For shares held in

athe Tompkins Financial Corporation Employee Stock Ownership Plan

(the “ESOP”) and the Tompkins Retirement Savings Plan (the “401(k) Plan”), the votes need to be cast by 6:00 a.m., Eastern Daylight Saving Time, on May

7, 2021.10, 2024. The last-dated proxy or voting instructions you submit (by any means) will supersede any previously submitted proxies and voting instructions.

Voting at the Annual Meeting.

If you are a record shareholder and you attend the Annual Meeting, you may vote by completing an onlinea ballot, which will be available at the Annual Meeting. SharesIf you wish to attend the Annual Meeting in person, you pre-register at least five (5) business days prior to the Annual Meeting by writing to Tracy Kinner, Executive Assistant, Tompkins Financial Corporation, PO Box 460, Ithaca, NY 14851, or by email at tkinner@tompkinsfinancial.com. Pre-registration and matching picture identification are necessary to gain entrance to the secure area of common stock covered by a proxy that isour headquarters building where the meeting will be held. If your shares are held in the ESOP or the 401(k) Plan, you may not vote in person at the Annual Meeting.

All properly executed andsigned proxies returned in time to be counted at the Annual Meeting will be voted and, ifby the shareholder who executes such proxy specifies thereinnamed proxies at the Annual Meeting. Where you have specified how suchyour shares shallshould be voted on such proposals, thea matter, your shares will be voted in accordance with your instructions; if you properly sign your proxy card, but you do not indicate how your shares should be voted on a matter, your shares will be voted as so specified.the Board recommends. Executed proxies with no instructions will be voted “FOR” each proposal for which no instruction is given. Other thanall Director Nominees listed in Proposal 1, and “FOR” Proposals 2 and 3.

If your shares are held in the

election of Directors;ESOP and/or the

advisory401(k) Plan, your vote

to approve the compensation paidwill serve as instructions to the

Company’s Named Executive Officers; and the proposal to ratify the appointmenttrustee of the

independent registered public accounting firm, KPMG LLP, as our independent auditor forESOP and/or the

fiscal year ending December 31, 2021, the Board is401(k) Plan. If you do not

aware of any other matters to be presented for shareholder action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting, the Board intends that the persons named in the accompanying proxy will vote the shares

representedallocated to your account, your shares will be voted by

all properly executed proxies on any such mattersthe trustee in

accordance with the

judgmentsame proportion as it votes the shares of the

person or persons acting underplan participants who instruct the

proxy,trustee on how to

the extent permitted by applicable law.vote.

Shareholders of record who submit proxies retain the right to revoke them at any time before they are exercised. Unless revoked, the common

sharesstock represented by such proxies will be voted at the Annual Meeting. If you are a shareholder of record, you may revoke your proxy at any time before it is actually exercised at the Annual Meeting by:

| ● | filing a written notice of revocation with the Corporate Secretary of Tompkins Financial Corporation at P.O. Box 460, Ithaca, New York 14851, which must be received prior to the Annual Meeting; |

| ● | executing and returning a later-dated proxy card, which must be received prior to the Annual Meeting; |

| ● | submitting a later vote via the Internet or telephone; or |

| ● | attending the Annual Meeting and voting at the Annual Meeting (attendance at the Annual Meeting will not, by itself, revoke your proxy). |

filing a written notice of revocation with the Deputy Corporate Secretary of Tompkins Financial Corporation at P.O. Box 460, Ithaca, NY 14851, which must be received prior to the Annual Meeting;

executing and returning a later-dated proxy card, which must be received prior to the Annual Meeting;

submitting a later vote via the Internet or telephone; or

attending the Annual Meeting and voting at the Annual Meeting (attendance at the Annual Meeting will not, by itself, revoke your proxy).

The last-dated proxy or voting instructions you submit (by any means) will supersede all previously-submitted proxies and voting instructions. If you hold your common

sharesstock in “street name” and instructed your broker, financial institution or other nominee to vote your common

sharesstock and you would like to revoke or change your vote, then you must follow the instructions received from your nominee to change your vote.

The presence, in person or by proxy, of the holders of at least a majority of the shares of

our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the conduct of business at the Annual Meeting.

Vote Required and Board Recommendations

Proposal No. 1 | | | Vote Required | | | Board of Directors Recommendation |

Election of Directors | | | A plurality of votes cast by holders of common stock entitled to vote thereon | | | “FOR” all Director nominees named in the Proxy Statement |

| | | | | | |

Proposal No. 2 | | | Vote Required | | | Board of Directors Recommendation |

Advisory Approval of the Compensation Paid to the Company’s Named Executive Officers | | | A majority of votes cast by the holders of common stock entitled to vote thereon | | | “FOR” advisory approval of the compensation paid to the Company’s Named Executive Officers |

| | | | | | |

| |

Proposal No. 3 | | | Vote Required | | | Board of Directors Recommendation |

Ratification of the appointment of the independent registered public accounting firm, KPMG LLP, as the Company’s independent auditor for the fiscal year ending December 31, 20212024 | | | A majority of votes cast by the holders of common stock entitled to vote thereon | | | “FOR” the ratification of the appointment of the independent registered public accounting firm, KPMG LLP, as the Company’s independent auditor for the fiscal year ending December 31, 20212024 |

The Company’s Board of Directors knows of no other business to be presented for shareholder action at the Company’s Annual Meeting. If any other matters are properly brought before the Annual Meeting, the individuals named on the proxy card will vote your shares in their discretion on such matters.

Abstentions and Broker Non-votes

At the Annual Meeting, abstentions, votes cast in person or by proxy and broker non-votes will each be counted for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker, bank, or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power on that matter and has not received instructions from the beneficial owner. At the Annual Meeting, broker non-votes and abstentions will have no effect on the outcome of any of the Company’s proposals. Brokers, banks or other nominees will not have discretionary authority to vote on Proposal

Nos.No. 1 or 2, but will have discretionary authority to vote on Proposal No. 3.

The enclosed proxy is being solicited by the

Board of Directors of the Company.Board. The total cost of solicitation of proxies in connection with the Annual Meeting will be borne by the Company. In addition to solicitation by mail, our

Directors,directors, officers and employees may solicit proxies for the Annual Meeting personally or by telephone or electronic communication without additional remuneration. The Company will also provide brokers and other record owners holding shares in their names or in the names of nominees, in either case which are beneficially owned by others, proxy materials for transmittal to such beneficial owners and will reimburse such record owners for their expenses in doing so.

At the Annual Meeting, thirteen (13) Directorstwelve (12) directors will be elected for a one-year term expiring at the 20222025 Annual Meeting, and with respect to each Director,director, until his or hertheir successor is elected and qualified. The following Director nominees—John E. Alexander, Paul J. Battaglia, Daniel J. Fessenden, James W. Fulmer, Patricia A. Johnson, Frank C. Milewski, Ita M. Rahilly, Thomas R. Rochon, Stephen S. Romaine, Michael H. Spain, Jennifer R. Tegan, Alfred J. Weber and Craig Yunker—director nominees are currently serving as Directors.directors: Nancy E. Catarisano; Daniel J. Fessenden; Patricia A. Johnson; Angela B. Lee; John D. McClurg; Ita M. Rahilly; Thomas R. Rochon; Stephen S. Romaine; Michael H. Spain; Jennifer R. Tegan; and Alfred J. Weber. Their terms expire in 2021,2024, and each is standing for re-election at the Annual Meeting. Each Directordirector was identified and nominated by the Nominating and Corporate Governance Committee for election at the Annual Meeting. Janet M. Coletti, currently serving on the Community Bank Board of Tompkins Community Bank Western New York, was also identified and nominated by the Nominating and Corporate Governance Committee for election at the Annual Meeting for a term of one year.

The

1312 nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected to the Board. The persons named in the

Proxyproxy to

represent shareholderscast votes represented by proxies at the Annual Meeting are

FrancisMatthew D. Tomazin and Cynthia M.

Fetsko and Amanda L. Lippincott.Manuele. The

Proxiesproxies will vote as directed and, in the absence of instructions, will vote the shares represented by properly-executed proxies in favor of the election of nominees named below.

In the event any nominee is unable or declines to serve as a

Directordirector at the time of the Annual Meeting, the proxies will be voted for the nominee, if any, who may be designated by the Board, upon recommendation of the Nominating and Corporate Governance Committee, to fill the vacancy. As of the date of this Proxy Statement, the Board is not aware that any nominee is unable or will decline to serve as a

Director.director.

Vote Required and Recommendation

Shareholders may vote “for” all Directordirector nominees as a group, may “withhold” authority to vote for all Directordirector nominees as a group, or may withhold authority to vote only for specified Director nominees. A plurality of votes cast by holders of shares of common stock entitled to vote thereon is required to elect the nominees. Under a plurality vote standard, the nominees who receive the highest number of votes “for” their election will be elected. Votes to “withhold” in an uncontested election will have no effect on the outcome of the vote on Proposal No. 1. Broker non-votes will not constitute or be counted as votes cast for purposes of this Proposal, and therefore will have no impact on the outcome of this Proposal.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

The Board of Directors unanimously recommends a vote “FOR”

THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. SHARES OF COMMON STOCK COVERED BY EXECUTED PROXIES RECEIVED BY THE BOARD OF DIRECTORS WILL BE VOTEDthe election of each of the director nominees. Shares of common stock covered by executed proxies received by the Board will be voted “FOR”

THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED BELOW UNLESS THE SHAREHOLDER SPECIFIES A DIFFERENT CHOICE.the election of each of the director nominees named below unless the shareholder specifies a different choice.

The following table sets forth each

Directordirector nominee

all of whom are existing Directors and includes such person’s name, age,

gender, race/ethnicity, and whether

he or she hasthey have been determined to be an

Independent Director.independent director. Biographies of the

Directordirector nominees follow the table.

Each Director wasDirectors Catarisano, Fessenden, Johnson, Lee, McClurg, Rahilly, Rochon, Romaine, Spain, Tegan, and Weber were elected for a one-year term expiring at the

20212024 Annual Meeting. The nominees identified below as

“Independent”“independent” are referred to in this Proxy Statement as the

Independent“Independent Directors.

| | John E. Alexander | Paul J. Battaglia | Daniel J. Fessenden | James W. Fulmer | Patricia A. Johnson | Frank C. Milewski | Ita M. Rahilly | Thomas R. Rochon | Stephen S. Romaine | Michael H. Spain | Jennifer R. Tegan | Alfred J. Weber | Craig

Yunker |

| Demographic Background (1) |

| Independence | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | No | Yes | Yes | Yes |

| Years on Board | 28 | 11 | 12 | 21 | 15 | 9 | 1 | 12 | 14 | 21 | 2 | 9 | 21 |

| Age | 68 | 69 | 55 | 69 | 65 | 70 | 59 | 68 | 56 | 63 | 50 | 68 | 70 |

| Gender |

| Male | X | X | X | X | | X | | X | X | X | | X | X |

| Female | | | | | X | | X | | | | X | | |

| Race/Ethnicity |

| Black/African American | | | | | X | | | | | | | | |

| Caucasian/White | X | X | X | X | | X | X | X | X | X | X | X | X |

Nancy E. Catarisano | | | Yes | | | 1 | | | 62 | | | | | | | | | X | | | | | | | | | X |

Janet M. Coletti | | | Yes | | | 0 | | | 60 | | | | | | | | | X | | | | | | | | | X |

Daniel J. Fessenden | | | Yes | | | 15 | | | 58 | | | | | | X | | | | | | | | | | | | X |

Patricia A. Johnson | | | Yes | | | 18 | | | 68 | | | | | | | | | X | | | | | | X | | | |

Angela B. Lee | | | Yes | | | 1 | | | 55 | | | | | | | | | X | | | | | | X | | | |

John D. McClurg | | | Yes | | | 1 | | | 62 | | | | | | X | | | | | | | | | | | | X |

Ita M. Rahilly | | | Yes | | | 4 | | | 62 | | | | | | | | | X | | | | | | | | | X |

Thomas R. Rochon | | | Yes | | | 15 | | | 71 | | | | | | X | | | | | | | | | | | | X |

Stephen S. Romaine | | | No | | | 17 | | | 59 | | | | | | X | | | | | | | | | | | | X |

Michael H. Spain | | | No | | | 24 | | | 67 | | | | | | X | | | | | | | | | | | | X |

Jennifer R. Tegan | | | Yes | | | 5 | | | 53 | | | | | | | | | X | | | | | | | | | X |

Alfred J. Weber | | | Yes | | | 12 | | | 72 | | | | | | X | | | | | | | | | | | | X |

| (1)

| Independence has been affirmatively determined by the Company’s Board of Directors in accordance with Section 803A of NYSE American Company Guide. Age and Years on Board has been calculated as of the date of this Proxy Statement, with years of board service rounded up to date of Annual Meeting. |

Director Qualifications, including Director Nominees

The following paragraphs provide information as of the date of this Proxy Statement regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that

he or shethey should serve as a

Director.director. The information presented includes information each

Directordirector has given us about positions

he or she holds, his or herthey hold, their principal occupation and business experience for the past five years, certain non-profit boards on which

he or she serves,they serve, and the names of other publicly-held companies of which

he or shethey currently

servesserve as a director or

hashave served as a director during the past five years.

JohnNancy E. AlexanderCatarisano has served as a Directordirector of the Company since 1995 and as a Director of Tompkins Trust Company since 1993. Mr. Alexander was a principal shareholder and served as President and Chief Executive Officer of The CBORD Group, Inc., a computer software company which Mr. Alexander founded in 1975, until July 2004. Mr. Alexander is a Director Emeritus of many local not-for-profit, community organizations and institutions of higher education, and has been a founding partner or member of several entrepreneurial firms following his retirement in 2004. We believe Mr. Alexander’s qualifications to sit on our Board of Directors include his executive leadership and management experience, as well as the financial expertise he has brought to bear during more than two decades of board service with our organization.

Paul J. Battaglia has served as a Director of the Company since 2010 and was a Director of TFA Management, Inc. f/k/a AM&M Financial Services, Inc. from April-December 2010. He has2023. She served as a Director for the Bank of Castile sincefrom July 2020 through its consolidation with TCB on January 2011. He became Chairman of the Audit/Examining Committee in May 2011. In 2015 he was appointed to the Board of Directors of TFA Management, Inc. and to the Corporate Credit Oversight Committee of the Company’s Board of Directors. Until his retirement in 2018, Mr. Battaglia served1, 2022. Ms. Catarisano also serves as a Managing Director of Freed Maxick CPAs, P.C.Tompkins Community Bank, and as a Community Bank Board Director for Tompkins Community Bank Western New York. Ms. Catarisano joined Insero & Co., a 300-person “Top 100” full-service public accounting firm headquarteredlocated in WesternRochester, New York. As a Managing Director, Mr. Battaglia managed the operations ofYork, in 1999 and currently serves as the firm’s Batavia office in addition to providing consultingManaging Partner. She founded the firm’s Outsource Accounting Services Group, and provides outsource financial services to her clients onthat include matters relating to accounting transaction processing and cash management, strategic planning, equity and debt financings, and mergers and acquisitions, design and implementationacquisitions. As Managing Partner, Ms. Catarisano has doubled the size of financing plans, estate planning and business succession planning. He served on the firm’s Executive, Compensation, and Finance Committees, and was a Trustee for the firm’s retirement plan. Hefirm. She is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants, and the New York State Society of Certified Public Accountants. Mr. Battaglia currently provides consulting services in the areas of mergers and acquisitions, estate and succession planning, trust administration and financing to various clients. Mr. Battaglia has demonstrated significant involvement through years of service as a director for regional economic development organizations, and through serviceMs. Catarisano serves on the boardsExecutive, Finance, Audit, and Investment Committees of the Al Sigl Community of Agencies, and is prior Chair of the agency’s Board of Trustees. She is also actively involved with many different business, community, and charitable and educational organizations.organizations across Western New York. We believe Mr. Battaglia’sMs. Catarisano’s qualifications to servesit on our Board of Directors include his 46her more than 20 years of experience in public accounting dealingexperience, active engagement with financialcharitable organizations, and accounting mattersher connections to the business community in Western New York.

Janet M. Coletti serves as Community Bank Board Director for complex organizations. HeTompkins Community Bank Western New York. Ms. Coletti joined the Community Bank Board for Western New York in January 2023. Prior to her retirement in 2020, Ms. Coletti served as Executive Vice President and Chief Human Resources Officer of M&T Bank, a Fortune 500 company headquartered in Buffalo, New York. Ms. Coletti started her career at M&T in 1985 and held numerous positions in the Consumer Banking and Business Banking divisions before becoming Chief Human Resources Officer in 2015. Ms. Coletti was directly responsible for leading and managing M&T Bank’s Human Resources functions, including recruiting, training and leadership development, compensation and benefits, diversity and inclusion, and employee engagement. She also served as a member of M&T Bank’s executive management committee, which was responsible for leading all bank activities and operations. Since November 2019, Ms. Coletti has acquiredserved on the board of Moog, Inc. (NYSE: MOG.A), a deep understandingworldwide designer, manufacturer and systems integrator of high performance precision motion and fluid controls and controls systems for a broad range of applications in aerospace and defense and industrial markets. She also serves on the board of Culain Capital Management, a specialty finance company. Ms. Coletti is involved with many community organizations in the greater Buffalo area, including Providence Farm Collective and the Roycroft Campus Corporation. We believe Ms. Coletti’s qualifications to sit on our Board include her 35 years of banking experience, public company experience as an executive and director, and her active engagement with numerous business and community organizations in the Western New York business environment during his years of working with commercial clients in the region.area.

Daniel J. Fessenden

has served as a Directordirector of the Company since 2009, as2009. He was a Directordirector of Tompkins Trust Company sincefrom January 2009 through its consolidation with TCB on January 1, 2022, and now serves as a Director of TFA Management, Inc. since 2011.for Tompkins Community Bank (effective January 2022). Effective January 2022, Mr. Fessenden also serves on TCB’s Community Bank Board for Central New York, where he also currently serves as Chair. Mr. Fessenden served as a member of the New York State Assembly from 1993 to 1999. He has served as the Executive Director of the Fred L. Emerson Foundation, a family foundation located in Auburn, New York since January 2007. From 2004 to 2006 he served as the founding Executive Director of the Cornell Agriculture & Food Technology Park, located in Geneva, New York. Mr. Fessenden has been actively engaged with numerous business, civic and educational organizations throughout the Central New York region. We believe Mr. Fessenden’s qualifications to sit on our Board of Directors include his extensive experience in government and public service, his executive experience in the private sector, his active engagement with civic organizations, and his deep connections to the Central New York business community.James W. Fulmer served as President of the Company from 2000 through 2006,

Patricia A. Johnson has served as a Directordirector of the Company since 2000, and Vice Chairman of the Company since January 1, 2007. Mr. Fulmer previously served as President and Chief Executive Officer of Letchworth Independent Bancshares Corporation from 1991 until its merger with the Company in 1999, as well as the President and Chief Executive Officer of the Bank of Castile from 1991 until his retirement on December 31, 2014. He continues to serve as the Chairman of Tompkins Bank of Castile, and has served in such capacity since 1991. Mr. Fulmer also serves as a Director of Tompkins VIST Bank; and Chairman and Director of Tompkins Insurance Agencies, Inc. He2006. Ms. Johnson served as a member of the Board of Directors of the Federal Home Loan Bank of New York from January 2007 to December 2017, and as Vice Chairman from January 2015 to December 2017. Mr. Fulmer actively serves as a director of several prominent Western New York community and cultural organizations. We believe Mr. Fulmer’s qualifications to sit on our Board of Directors include his nearly 40 years of experience in the banking industry, including service as our Vice Chairman, and as the former President and Chief Executive Officer of Tompkins Bank of Castile.Patricia A. Johnson has served as a Director of the Company since 2006, served as a Director of Tompkins Trust Company from 2002 to 2014, and has served as a Directordirector of Tompkins VIST Bank sincefrom April 2014. In2014 through its consolidation with TCB on January 2014,1, 2022. She now serves as a Director for Tompkins Community Bank

(effective January 2022), and also serves on TCB’s Community Bank Board for Pennsylvania. Ms. Johnson

becamepreviously served as the Vice President for Finance and Administration with Lehigh University in Bethlehem,

PA.PA, retiring in June of 2022. She had previously been with Cornell University, starting as the Assistant Treasurer in 1995, and later serving as Associate Vice President & Treasurer. Ms. Johnson has served on the boards of several regional economic development/workforce training organizations, and she has demonstrated civic leadership through her service on the boards of many local charitable or educational institutions. We believe Ms. Johnson’s qualifications to sit on our Board

of Directors include her accounting expertise and her ability to understand and evaluate the Company’s complex financial operations.

Frank C. Milewski Angela B. Lee has served as a Directordirector of the Company since 2012, when he was appointed by the Board to fill a vacancy following the Company’s acquisition of VIST Financial Corporation (“VIST”). Mr. Milewski served as Vice Chairman of the Board of VIST from 2007 to 2012, where he2023. She served as a Director for Tompkins Trust Company from 2002 untilDecember 2021 through its acquisition by the Company. Mr. Milewski servedconsolidation with TCB on January 1, 2022. She now serves as a Director for Tompkins Community Bank, and also serves as a Community Bank Board Director for Tompkins Community Bank Central New York. She is Chief Diversity Officer at Baxter International, Inc. (“Baxter International”), a global public medical healthcare company, where she works to help the organization enhance a culture of Merchants Bank from 1985 until VIST acquired Merchants in 1999,belonging by leading efforts to embed diversity, equity, and hasinclusion across all aspects of Baxter’s business. Previously, Ms. Lee served as a Director of Tompkins VIST Bank since 1999. From December 2015 until his retirement in January 2017, Mr. Milewski served as a Regional Vice President of Molina Health Care (NYSE: MOH) which providesHuman Resources, and manages government-sponsored social services. Formerly, he wasChief Talent & Diversity Officer at the Regional President of Providence Service Corporation,recently acquired Hill-Rom Holdings, Inc. prior to its acquisition by Molina,Baxter International. Ms. Lee has more than 25 years of experience as a human resources executive, which includes extensive strategic business partnering skills; talent management; talent acquisition; total rewards; diversity, equity and was the founder, Presidentinclusion; employee relations; and Chief Executive Officercultural integration. Ms. Lee is an active member of The ReDCo Group prior to its acquisition by Providence Service Corporation in 2004. Mr. Milewski is involvedher community, working with many economic developmentcivic and civiccharitable organizations in the Schuylkill County region.Central New York area. We believe Mr. Milewski’sMs. Lee’s qualifications to sit on our Board of Directors include his executiveher extensive human resource experience, in a leadership position with a publicly-traded company, his prior service on VIST’s Audit/Examining Committeeher work to further diversity, equity, and inclusion initiatives, and her connections to the Tompkins VIST Bank Board of Directors,Central New York business and his community involvement.

Ita M. Rahillycivic community.

John D. McClurg has served as a Directordirector of Tompkins Mahopac Bankthe Company since 2018 and2023. He served as a Director for the Bank of Castile from 1995 through its consolidation with TCB on January 1, 2022. He now serves as a Director for Tompkins Community Bank, a Community Bank Board Director for Tompkins Community Bank Western New York, and Chair of the Western New York Bank Loan Committee. Mr. McClurg has served as president of McClurg Chrysler Dodge Jeep Ram since 1989 and McClurg Chevrolet since 1991. He has been a member of the New York State Automobile Dealers Association since 2013 and served as its Chair from 2018 to 2019. He also serves as a member of the boards for the National Auto Dealers Association and the New Car Dealers of Western NY Charitable Foundation. Mr. McClurg has served many local charitable organizations. We believe Mr. McClurg’s qualifications to sit on our Board include his deep ties to the Western New York community and his 40 plus years of experience owning and operating an automobile dealership.

Ita M. Rahilly has served as a director of the Company since 2020. She served as a director of Tompkins Mahopac Bank from 2018 through its consolidation with TCB on January 1, 2022. Effective January 2022, Ms. Rahilly now serves as a Director for Tompkins Community Bank, and she serves on TCB’s Community Bank Board for the Hudson Valley. She is the owner of Ita M. Rahilly CPA PC, and has been a Partner with the firm of RBT CPAs, LLP in Newburgh, NY since January 1, 2005, where she is the Partner in charge of the firm’s taxtrust estate and gift division, assisting closely-held businesses and their shareholders, and high net worth individuals in achieving their goals. Ms. Rahilly is an Accredited Estate Planner, a member of the Governing Council of the American Institute of Certified Public Accountants (AICPA), a past President of the New York State Society of Certified Public Accountants (NYSSCPA), a member of the National Association of Estate Planners and Councils, (NAEPC), and a member of the Hudson Valley Estate Planning Council. Ms. Rahilly also serves on the board of directors of the State University of New York at New Paltz Foundation and is a member of its Audit Committee. Ms. Rahilly is highly regarded by clients and peers and widely recognized for her expertise in estates, trusts and succession planning, corporate, partnerships, international taxation, and non-profit information reporting. We believe Ms. Rahilly’s qualifications to sit on our Board of Directors include her 3540 years of extensive public accounting experience dealing with financial and accounting matters for complex organizations. She has acquired a deep understanding of the Hudson Valley business environment during her years of working with commercial clients in the region.

Thomas R. Rochon has served as a Directordirector of the Company since 2009, and was elected ChairmanChair of the Board in May 2014. He has served as a Directordirector of Tompkins Mahopac Bank sincefrom July 2017 through its consolidation with TCB on January 1, 2022, and he served as a Directordirector of Tompkins Trust Company from January 2009 to June 2017. Effective January 2022, Mr. Rochon now serves as a Director for Tompkins Community Bank, and he serves on TCB’s Community Bank Board for the Hudson Valley. In July 2017, Dr. Rochon joined the Educational Records

Bureau (ERB), a not-for-profit educational testing and assessment company based in New York. He was named President of ERB in December 2017. From July 2008 through June 2017, Dr. Rochon served as President of Ithaca College. He has served on the boards of a number of organizations related to higher education and community service, and is actively involved with several local charitable and community service organizations. We believe Dr. Rochon’s qualifications to sit on our Board

of Directors include his many years of management experience, including as President of ERB and as former President of Ithaca College, as well as an understanding of the challenges faced by organizations that operate in a heavily regulated sector.

Stephen S. Romaine

has served as a Directordirector of the Company since 2007. Mr. Romaine was appointed President and Chief Executive Officer of the Company effectivein January 1, 2007. He had served as President and Chief Executive Officer of Tompkins Mahopac Bank from January 1, 2003 through December 31, 2006. Prior to this appointment, Mr. Romaine was Executive Vice President, Chief Financial Officer of Mahopac National Bank. In addition to the Company Board, Mr. Romaine serves on the boards ofTCB Board, and maintains an advisory role on TCB’s Community Bank Boards in each of its affiliates and has served as the Chairman of the Board of Directors of Tompkins Trust Company since May 2014.local markets. Mr. Romaine currently serves on the Board of the Federal Home Loan Bank of New York, as well as the New York Bankers Association, where he served as ChairmanChair from March 2016 through March 2017. His recent civic involvement includes service as a member of the boards of local historical and educational institutions. We believe Mr. Romaine’s qualifications to sit on our Board of Directors include his more than 30 years as an executive in the financial services industry, including his current position as President and Chief Executive Officer of the Company.

Michael H. Spain

has served as a Directordirector of the Company since 2000 and2000. Mr. Spain served as a Directordirector of Tompkins Mahopac Bank since 1992.from 1992 through its consolidation with TCB on January 1, 2022. Effective January 2022, Mr. Spain now serves as a Director for Tompkins Community Bank. He was appointedbegan serving as the ChairmanChair of the Board of Directors of Tompkins Mahopac Bank in June 2017.2017, and now chairs the TCB Community Bank Board for Hudson Valley (effective January 2022). Mr. Spain serves as Executive Vice President of Brown & Brown of New York, Inc., d/b/a the Spain Agency, an insurance agency located in Mahopac, New York. Mr. Spain served as President of the Spain Agency from 1989 until 2015 when it became wholly owned by Brown & Brown, Inc. Mr. Spain also holds leadership positions with several privately-held real estate development companies and is involved with many charitable organizations in the Hudson Valley. We believe Mr. Spain’s qualifications to sit on our Board of Directors include his more than 20 years of service as a Tompkins Mahopac Bank Director, and his extensive executive experience in the financial services industry.

Jennifer R. Tegan has served as a Director of Tompkins Trust Company since 2016 and as a Directordirector of the Company since 2019. Ms. Tegan served as a director of Tompkins Trust Company from 2016 through its consolidation with TCB on January 1, 2022. Effective January 2022, Ms. Tegan serves as a Director for Tompkins Community Bank, and she serves on TCB’s Community Bank Board for Central New York. She is Managing Director of NY Ventures, Division of Small Business and Technology Development of Empire State Development, where she is charged with leading investments in high growth start-up businesses across the state of New York. From 2002-2020 she worked with Cayuga Venture Fund (CVF) located in Ithaca, NY, supporting and financing entrepreneurs in technology-based companies across a broad spectrum of industries. Ms. Tegan has served on the boards of several privately-owned companies as well as a national trade organization board.the board of the National Venture Capital Association. Ms. Tegan is past President and current Executive Committee Member of the Upstate Capital Association of NY Board, a membership trade organization whose mission is to increase access to capital for entrepreneurs and companies in upstate New York. Ms. Tegan’s civic commitments include past service on the board of a local educational organization,directors of the Elizabeth Ann Clune Montessori School of Ithaca, as well as board service for non-profit organizations which support regional economic growth and capital access for regional entrepreneurs. We believe Ms. Tegan’s qualifications to sit on our Board of Directors include her extensive experience fostering the development of early-stage businesses in our local market, the banking industry knowledge she has acquired through her service as a Directordirector of Tompkins Trust Company, and her demonstrated commitment to local, regional and state economic development, and other civic engagement in the Tompkins County region.

Alfred J. Weber has served as a Directordirector of the Company since August 2012 and as ChairmanChair of the Board of VIST Financial Corporation from 2005 to 2012, where he served as a Directordirector from 1995 until its acquisition by the Company in August 2012. He iswas a Directordirector of Tompkins VIST Bank, and haswhere he also served as Chair, from 2005 through its Chairman since 2005.consolidation with TCB on January 1, 2022. Effective January 2022, Mr. Weber now serves as a Director for Tompkins Community Bank, and he serves on TCB’s Community Bank Board for Pennsylvania, for which he is Chair. Mr. Weber is President of Tweed-Weber,Tweed-Weber-Danks, Inc., a management consulting firm. He has been in the consulting industry since 1974, and the president of his own business since 1984. The fundamental focus of his work

is to help clients build and implement strategies to gain and sustain competitive advantage in their marketplace. Mr. Weber has worked with hundreds of businesses, not-for-profit organizations, health and home care agencies, and associations across the country. He currently serves on several community development boards in the Berks County, Pennsylvania region, and serves on the board of directors of three privately-held companies in the manufacturing/retail industries. We believe Mr. Weber’s qualifications to sit on our Board

of Directors include his experience in leading change initiatives and his expertise in the area of strategic planning.

Craig Yunker has served as a Director of the Company since 2000 and as a Director of Tompkins Bank of Castile since 1991. He has been the Managing Partner of the following farming companies: CY Farms, LLC since 1976 and CY Properties, LLC; CY Heifer Farm, LLC; and Batavia Turf, LLC since 1998. Since 2001, Mr. Yunker has served as a Trustee of Cornell University. He is closely involved with the Western and Central New York business community, and currently serves in leadership roles on both state and national agricultural organizations. Mr. Yunker is a Director on local boards committed to economic development and manufacturing in Western New York, and he also serves on the board of a privately-held local manufacturing company. We believe Mr. Yunker’s qualifications to sit on our Board of Directors include his extensive executive experience, particularly in the agribusiness sector, his corporate strategy acumen, and over 20 years of service.

The names and ages of the Company’s executive officers, including the

Named Executive Officersnamed executive officers identified in the Summary Compensation Table in this Proxy Statement, their positions and offices held with the Company, their term of office and experience are set forth in Part I of the Company’s Annual Report,

on Form 10-K for the Company’s 2020 fiscal year, a copy of which is

enclosed with this Proxy Statement.included in the proxy materials.

MATTERS RELATING TO THE BOARD OF DIRECTORS

During fiscal

20202023, the Board

of Directors held four regular meetings, one informational meeting and

twothree strategic planning meetings. As a matter of practice, the Independent Directors met in executive session at the end of each regular meeting for a total of four such sessions during

2020.2023. During this period all of the

Directorsdirectors attended more than 75% of the aggregate of the total number of meetings of the Board held during the periods that

he or shethey served and the total number of meetings held by all committees of the Board on which each such

Directordirector served during the period that

he or shethey served.

The Board currently maintains and appoints the members of the following sixfour standing committees: Executive, Compensation, Audit/Examining,Audit & Risk, and Nominating and Corporate Governance, Qualified Plans Investment Review, and Corporate Credit Oversight.

Governance.John E. Alexander | — | — | — | X | Chair | — | | | — | | | X |

Paul J. Battaglia | X | — | ChairX | — | — | X— | | | Chair | | | — |

Nancy E. Catarisano | | | — | | | — | | | X | | | — |

Daniel J. Fessenden | X | — | —X | Chair | — | X | | | — | | | Chair |

James W. Fulmer | X | — | X | — | — | Chair— | | | X | | | — |

Patricia A. Johnson | — | X | —X | — | — | Chair | | | X | | | — |

Frank C. MilewskiAngela B. Lee | — | — | X— | — | — | — | | | — | | | X |

John D. McClurg | | | — | | | — | | | — | | | — |

Ita M. Rahilly | — | — | X— | — | — | — | | | X | | | — |

Thomas R. Rochon | Chair | X | —Chair | X | — | X | | | — | | | X |

Stephen S. Romaine | X | — | —X | — | X | X— | | | — | | | — |

Michael H. Spain | — | — | — | — | X | — | | | — | | | — |

Jennifer R. Tegan | — | — | X— | — | — | X | | | — | | | — |

Alfred J. Weber | — | X | — | — | — | — |

Craig YunkerX | X | Chair | — | X | — | — |

Executive Committee.

The Board has adopted a written charter for the Executive Committee. A copy of the Executive Committee’s charter is posted in the “About Us - Corporate Governance” section of the Company’s website (www.tompkinsfinancial.com). The Executive Committee did not meet during fiscal 2020.2023. The Executive Committee acts, as necessary, on behalf of the Board of Directors pursuant to the Company’s Second Amended and Restated Bylaws (the “Bylaws”).

Compensation Committee.

The Board has adopted a written charter for the Compensation Committee (as used in this paragraph, the “Committee”). A copy of the Committee’s charter is posted in the “About Us - Corporate Governance” section of the Company’s website (www.tompkinsfinancial.com). The Committee met threeeight times during fiscal 2020.2023. The Committee reviews executive performance and approves, or recommends to the Independent Directors for approval, salaries and other matters relating to executive compensation, except that the compensation of the Chief Executive Officer is determined by the Independent Directors upon recommendation by the Committee. It also administers the Company’s equity incentive plans, including reviewing and granting equity incentive awards to executive officers and other employees. The Committee also reviews and approves various other compensation policies and matters, and is responsible for ensuring that executive officers are compensated effectively, appropriately, and in a manner consistent with the Company’s objectives. Please see the heading “Role of the Compensation Committee, Management, and Consultants” on page 1819 for information about this Committee’s responsibilities and activities. Each of the members of this Committee is an “Independent Director” as defined in Section 803A of the NYSE American Company Guide, and also meets the heightened independence standards for compensation committee members set forth in NYSE American Rule 805(c).Audit/Examining

Compensation Committee Interlocks and Insider Participation.

The members of the Company’s Compensation Committee are identified above under “Board of Directors: Committee Membership.” No member of the Compensation Committee was during fiscal 2023 or before an officer or employee of the Company or any of the Company’s subsidiaries, or had any relationship requiring disclosure under

“Transactions with Related Persons” in this Proxy Statement. During 2023, no executive officer of the Company served on the board of directors or compensation committee of any other entity, one of whose executive officers served as a member of the Company’s Board of Directors or the Compensation Committee.

Audit & Risk Committee. The Board has adopted a written charter for the Audit/ExaminingAudit & Risk Committee (as used in this paragraph, the “Committee”). A copy of the Committee’s charter is posted in the “About Us - Corporate Governance” section of the Company’s website (www.tompkinsfinancial.com). The Committee met ten times during fiscal 2020.2023. This Committee assists the Board in its general oversight of accounting and financial reporting, internal controls and audit functions, and is directly responsible for the appointment, compensation and oversight of the work of the Company’s independent auditors. The responsibilities and activities of the Committee are described in greater detail in the “Report of the Audit/ExaminingAudit & Risk Committee of the Board of Directors” included in this Proxy Statement. The Board has determined that Paul J. Battaglia, Nancy E. Catarisano, James W. Fulmer, Frank C. Milewski,Patricia A. Johnson, and Ita M. Rahilly and Jennifer R. Tegan each qualify as an “Audit Committee Financial Expert” as defined in Item 407(d) of Regulation S-K and that each of the members of the Audit/ExaminingAudit & Risk Committee is an “Independent Director” as defined in Section 803A of the NYSE American Company Guide, and also satisfies the heightened independence standards applicable to Audit Committee members of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Nominating and Corporate Governance Committee.

The Board has adopted a written charter for the Nominating and Corporate Governance Committee (as used in this paragraph, the “Committee”). A copy of the Committee’s charter is posted in the “About Us - Corporate Governance” section of the Company’s website (www.tompkinsfinancial.com). The Committee met fourfive times during fiscal 2020.2023. This Committee is responsible for assisting the Board in developing corporate governance

policies and practices that comply with applicable laws and regulations, including NYSE American listing standards and corporate governance requirements. The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending qualified candidates for election to the Board.

The Committee identified first-time director nominee Janet M. Coletti through her service on community bank board committees of the Board of Directors of Tompkins Community Bank.

Director Qualifications.

To be considered for nomination to the Company’s Board, each candidate must possess the following minimum qualifications and attributes: high personal values, judgment and integrity; an ability to understand the regulatory and policy environment in which the Company conducts its business; a demonstrated, significant engagement in one of the market areas served by the Company, based on one or more of the following within such market area—professional/business relationships, residence, and involvement with civic, cultural or charitable organizations; and experience which demonstrates an ability to deal with the key business, financial and management challenges that face financial service companies. The Company believes that such connections with one of the Company’s local communities foster ties between the Company and that community, and also allow the Directordirector to better understand the banking and financial services needs of its local stakeholders. The Nominating and Corporate Governance Committee will consider the Director’sdirector’s independence, qualifications and contributions and the continued need for our board to reflect a diversity of personal backgrounds and professional experience, and will balance the value brought by longer-tenured directors with the benefits of periodic refreshment of directors.While individual experiences and qualifications serve as a baseline for consideration, the Company recognizes that the Board

of Directors governs as a whole, and not as a collection of individuals. The effectiveness of the Board is not a function of the individual attributes of its members; rather, it depends on the overall chemistry of the Board. Therefore, the Nominating and Corporate Governance Committee assesses whether a particular candidate will be able to function within this broader context by evaluating

his or her:their: ability to understand, and willingness to engage, the issues presented to the Board; ability to exercise prudence and judgment, but also decisiveness; and ability to effectively communicate

his or hertheir ideas to the other members of the Board. In the case of incumbent Directors, these assessments are made based on past experience with a particular Director and, in the case of first-time nominees, these issues are explored during the interview and vetting process described below.

Identification of Candidates & Nomination Process. At least annually, and typically on a more frequent basis, the Committee engages in a discussion to identify candidates who fulfill the criteria described above, under the heading “Director Qualifications.” The Nominating and Corporate Governance Committee will evaluate candidates who are identified by shareholders, by other members of the Board, and occasionally by members of the Company’s leadership team, which is comprised of the Company’s executive officers. To be considered, shareholder recommendations of director candidates must be received by the ChairmanChair of the Nominating and Corporate Governance Committee, Tompkins Financial Corporation, P.O. Box 460, Ithaca, NY 14851, no later than December 1stof the year

preceding the annual meeting at which such candidate is proposed to be nominated. The recommendations should include the name, address, and supporting information as to why the candidate should be considered by the Committee. The same procedures are used to evaluate all candidates, regardless of the source of the recommendation.

Tompkins values the benefits that diversity can bring to its

Board of Directors.Board. A diverse board reflects a variety of important perspectives in the boardroom, ultimately resulting in more informed decision-making. Accordingly, in identifying potential nominees, the Nominating and Corporate Governance Committee also considers whether a particular candidate adds to the overall diversity of the Board. The Committee seeks nominees with a broad diversity of experience, professions and perspectives, including diversity with respect to race, gender, geography, and areas of expertise. The Committee ensures that women and minority candidates are included in the candidate pool from which director nominees are selected, and it employs a variety of strategies to help develop a diverse candidate pool. First, the Committee strongly encourages all of our directors to identify qualified women and minority candidates for service on our Board. The Committee also recognizes the importance of recruiting candidates beyond the traditional corporate/banking arena, and for example, recruits qualified candidates who work in academic institutions or non-profit organizations, in addition to candidates with traditional “corporate” backgrounds. At least annually, the Committee monitors the composition of the Board to ensure it reflects a broad diversity of experience, professions, and perspectives, including diversity with respect to race, gender, geography, and areas of expertise. While not encapsulated in a written policy, the Committee and the Board stand behind these commitments to diversity practices and monitoring. Of our

thirteen (13)twelve (12) current directors

and one (1) director nominee, all of whom are standing for

election and re-election at the

20212024 Annual Meeting,

threesix identify as women and

one identifiestwo identify as

a personpersons of color.

Once the Nominating and Corporate Governance Committee has determined its interest in a potential nominee, it begins discussions with

him or herthem as to

his or hertheir willingness to serve on the Board and one of the Company’s

subsidiarylocal market boards and, for first-time nominees, an interview will be conducted. If the nominee is an incumbent Director, the Committee will consider prior Board performance and contributions as described above; in the case of a first-time nominee, the Committee will evaluate its discussions with the candidate, and the Committee may also seek to verify its preliminary assessment of the

candidate by discussing his or hertheir particular attributes with other appropriate parties who have had prior professional experiences with him or her.them. At the conclusion of this process, the Committee will recommend qualified candidates that best meet the Company’s needs to the full Board, which then selects candidates to be nominated for election at the next annual meeting of shareholders. The Committee uses the same process for evaluating all candidates, whether recommended by shareholders, Directors or management. The Company expects all Board members to own at least 2,000 shares of the Company’s common stock, which shares may be accumulated over a period of three years following a Director’s initial election to the Board. Shares held in a rabbi trust as deferred stock compensation for a given Director, are included in this calculation.

Qualified Plans Investment Review Committee. The Board has adopted a written charter for the Qualified Plans Investment Review Committee (as used in this paragraph, the “Committee”). This Committee met two times during fiscal 2020, and it is responsible for reviewing and setting the investment goals and objectives of the Tompkins Financial Corporation Retirement Plan, monitoring the performance of the third-party investment manager engaged to invest plan assets, and overseeing changes to plan holdings. This Committee also serves in a fiduciary capacity for the Company’s 401(k) retirement plan, which duties include, but are not limited to: investment fund selection; establishing investment policy objectives; benchmarking and evaluating the reasonableness of fund fees, overall plan expenses, revenue-sharing arrangements, and performance of the investment funds and the third-party administrator.

Corporate Credit Oversight Committee. The Board has adopted a written charter for the Corporate Credit Oversight Committee (as used in this paragraph, the “Committee”). This Committee met nine times in fiscal 2020, and is charged with the general oversight of the commercial, consumer and residential lending mortgage portfolios across the affiliates of the Company. In addition, the Committee is asked to approve larger commercial relationships in excess of $22 million in borrowings.

It is the general policy of the Board that employee directors are not paid for their service on the

Company’s Board

of Directors beyond their regular employee compensation. The following table sets forth the compensation paid to the Company’s non-employee directors for their service during

2020:| 2020 Director Compensation |

| Name | | Fees Earned or

Paid in Cash(1) | | Stock

Awards(2) | | All Other

Compensation | | Total |

| | | ($) | | ($) | | ($) | | ($) |

| Alexander | | — | | 58,300 | | — | | 58,300 |

| Battaglia | | — | | 85,700 | | — | | 85,700 |

| Fessenden | | 46,000 | | 27,200 | | — | | 73,200 |

| Fulmer | | 80,400 | | — | | — | | 80,400 |

| Johnson | | 53,500 | | — | | — | | 53,500 |

| Milewski | | 69,600 | | — | | — | | 69,600 |

| Rahilly | | 49,103 | | — | | — | | 49,103 |

| Rochon | | 30,100 | | 90,300 | | — | | 120,400 |

| Spain | | 30,400 | | 30,000 | | — | | 60,400 |

| Tegan | | — | | 62,100 | | — | | 62,100 |

| Weber | | 22,400 | | 34,300 | | — | | 56,700 |

| Yunker | | 69,600 | | — | | — | | 69,600 |

| | | ($) | | | ($) | | | ($) | | | ($) | |

Alexander | | | — | | | 81,000 | | | — | | | 81,000 | |

Battaglia | | | 122,300 | | | — | | | — | | | 122,300 | |

Catarisano | | | — | | | 68,767 | | | — | | | 68,767 | |

Fessenden | | | 37,600 | | | 67,100 | | | — | | | 104,700 | |

Fulmer | | | 112,780 | | | — | | | — | | | 112,780 | |

Johnson | | | 95,384 | | | — | | | — | | | 95,384 | |

Lee | | | — | | | 58,367 | | | — | | | 58,367 | |

McClurg | | | 76,667 | | | — | | | — | | | 76,667 | |

Milewski | | | 41,626 | | | — | | | — | | | 41,626 | |

Rahilly | | | 93,300 | | | — | | | — | | | 93,300 | |

Rochon | | | 93,400 | | | 93,400 | | | — | | | 186,800 | |

Spain | | | 94,200 | | | — | | | — | | | 94,200 | |

Tegan | | | 21,000 | | | 71,300 | | | — | | | 92,300 | |

Weber | | | 30,700 | | | 55,500 | | | — | | | 86,200 | |

Yunker | | | 40,173 | | | — | | | — | | | 40,173 | |

(1)

| (1) | Amounts disclosed for certain Directors include cash compensation for service on subsidiary boards. For a more detailed discussion of such fees, see “Subsidiary“Community Bank Board and Committee Service Compensation”Compensation” below. |

(2)

| (2) | The stock awards disclosed here reflect grant date fair value in accordance with ASC Topic 718, and were earned by the Directors and deferred under Tompkins’ Amended and Restated Plan for Eligible Directors of Tompkins Financial Corporation and Wholly-Owned Subsidiaries (the “Retainer Plan”). The stock awards under the Retainer Plan are discussed in more detail below under the heading “Timing“Timing and Manner of Payment of Director Compensation.Compensation.” Dividends are reinvested pursuant to the Company’s Dividend Reinvestment and Stock Purchase and Sale Plan. |

The Company paid non-employee Directorsdirectors annual fees as shown in the table below. The fees are paid in quarterly installments. Chair retainer fees are paid in lieu of the applicable committee retainer fees. These amounts are all included in the aggregate for each director in the table, “2020“2023 Director Compensation,” above.

| | | Non-Employee Director | | Chair Retainer Fee | | Committee Retainer Fee |

| | | ($) | | ($) | | ($) |

| Annual Retainer | | 26,800 | | | | |

| Audit/Examining Committee | | | | 21,400 | | 10,700 |

| Nominating and Corporate Governance Committee | | | | 10,700 | | 7,500 |

| Compensation Committee | | | | 10,700 | | 7,500 |

| Corporate Credit Oversight Committee | | | | 10,700 | | 7,500 |

| Qualified Plans Investment Committee | | | | 4,800 | | 3,200 |

| | | ($) | | | ($) | | | ($) |

Annual Retainer | | | 37,600 | | | | | | |

Audit & Risk Committee | | | | | | 30,000 | | | 15,000 |

Nominating and Corporate Governance Committee | | | | | | 15,000 | | | 10,500 |

Compensation Committee | | | | | | 15,000 | | | 10,500 |

Qualified Plans Investment Review Committee | | | | | | 6,600 | | | 4,500 |

All non-employee

Directors’directors’ fees paid for service on the Board were paid in cash or, if a valid election was made by the

Directordirector prior to January 1,

2020,2023, such Directors’ fees were deferred pursuant to (i) the Retainer Plan or (ii) pursuant to a Deferred Compensation Agreement.

In lieu of any retainer and/or committee fees (including the subsidiarycommunity bank board retainer fees described below), an annual retainer was paid in deferred stock to Thomas R. Rochon in 20202023 for his service as ChairmanChair of the Tompkins Financial Corporation Board, of Directors, as well as his service on the Community Bank Board of our MahopacTompkins Community Bank subsidiary,Hudson Valley, in the amount of $120,400,$186,800, paid in quarterly installments of $30,100.$46,700. For his service during 2020,2023, in lieu of any committee fees (including the subsidiarycommunity bank board retainer fees described below), James W. Fulmer received $80,400$112,780 paid in

quarterly installments of

$20,100$28,195 for his service as Vice

ChairmanChair of the Board,

and Chair of the Credit Oversight Committee, as well as his service on the

Community Bank Boards of

our VISTTompkins Community Bank

Pennsylvania and Tompkins Community Bank

Western New York, on the Board of

Castile, and Tompkins Insurance Agencies

subsidiaries.subsidiaries, and on the Audit & Risk Committee.

The Nominating and Corporate Governance Committee recommends the amount and form of director compensation to the Company’s Board, and the Board reviews director compensation annually.

In October 2019, the Board approved a 4% increase in director compensation, to be effective January 1, 2020. In October 2020, the Board declined to increase director compensation in recognition of the economic uncertainty brought on by the COVID-19 pandemic.Subsidiary

Community Bank Board and Committee Service Compensation

With the exception of Thomas R. Rochon and James W. Fulmer, who are paid the annual retainers described above, non-employee members of the

Company’s Board

of Directors who also sit on our

subsidiarycommunity bank boards receive the following annual fees in quarterly installments. These amounts are all included in the aggregate for each director in the table,

“2020“2023 Director Compensation,” above:

Tompkins

Community Bank

of Castile| Name | | Board Retainer Fee | | Bank Loan Committee Retainer Fee |

| | | ($) | | ($) |

| Battaglia | | 19,200 | | 5,400 |

| Fulmer | | — | | — |

| Yunker | | 19,200 | | 5,400 |

Tompkins Mahopac Bank

| Name | | Board Retainer Fee | | Board Chair Retainer Fee | | Bank Loan Committee Chair Retainer Fee |

| | | ($) | | ($) | | ($) |

| Rahilly | | 19,200 | | __ | | 5,400 |

| Rochon | | — | | — | | — |

| Spain | | 19,200 | | 3,200 | | 8,000 |

Tompkins Trust Company

Name | Board Retainer Fee | Bank Loan Committee Retainer Fee | Bank Loan Committee Chair Retainer Fee | Trust Committee Retainer Fee |

| | ($) | ($) | ($) | ($) |

| Alexander | 19,200 | — | — | — |

| Battaglia | — | — | — | 5,400 |

| Fessenden | 19,200 | — | 8,000 | 8,500 |

| Tegan | 19,200 | 5,400 | — | — |

Tompkins VIST Bank

Name | Board Retainer Fee | Bank Chair Retainer Fee | Board Loan Committee Retainer Fee |

| | ($) | ($) | ($) |

| Fulmer | — | — | — |

| Johnson | 19,200 | — | — |

| Milewski | 19,200 | — | 5,400 |

| Weber | 19,200 | 3,200 | — |

| | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) |

Tompkins Community Bank Western New York |

Battaglia | | | 26,300 | | | — | | | 7,400 | | | — | | | 10,500 | | | 10,500 |

Catarisano | | | 26,300 | | | — | | | 7,400 | | | — | | | — | | | — |

Fulmer | | | — | | | — | | | — | | | — | | | — | | | — |

McClurg | | | 26,300 | | | — | | | 7,400 | | | 3,500 | | | — | | | 7,000 |

Yunker | | | 10,915 | | | — | | | 3,071 | | | — | | | — | | | — |

| | | | | | | | | | | | | | | | | | |

Tompkins Community Bank Hudson Valley |

Rahilly | | | 26,300 | | | — | | | 7,400 | | | — | | | 7,000 | | | — |

Rochon | | | — | | | — | | | — | | | — | | | — | | | — |

Spain | | | 26,300 | | | 4,400 | | | 7,400 | | | 3,500 | | | — | | | 10,500 |

| | | | | | | | | | | | | | | | | | |

Tompkins Community Bank Central New York |

Alexander | | | 26,300 | | | — | | | — | | | — | | | — | | | — |

Fessenden | | | 26,300 | | | 4,400 | | | 7,400 | | | 3,500 | | | 3,500 | | | — |

Lee | | | 26,300 | | | — | | | — | | | — | | | — | | | — |

Tegan | | | 26,300 | | | — | | | 7,400 | | | — | | | — | | | 10,500 |

| | | | | | | | | | | | | | | | | | |

Tompkins Community Bank Pennsylvania |

Fulmer | | | — | | | — | | | — | | | — | | | — | | | — |

Johnson | | | 26,300 | | | — | | | 5,500 | | | 4,184 | | | — | | | — |

Milewski | | | 10,915 | | | — | | | — | | | 4,524 | | | — | | | 4,358 |

Weber | | | 26,300 | | | 4,400 | | | 7,400 | | | — | | | — | | | — |

Timing and Manner of Payment of Director Compensation

All retainer and other fees for service on the Company’s Board, as well as service on the Board of Directors of one or more of our subsidiaries, are payable quarterly, either in cash or, if a timely election is made by the